In the world of cryptocurrencies, Ethereum has established itself as a pioneer, revolutionizing the way we perceive digital assets and decentralized applications. With the advent of Ethereum 2.0, a major upgrade to the existing Ethereum blockchain, a new and exciting opportunity for investors and enthusiasts has emerged – staking to earn passive income with ETH.

Understanding Ethereum 2.0

Ethereum 2.0, often referred to as ETH 2.0 or Serenity, is a substantial upgrade to the Ethereum blockchain. It aims to address the scalability and energy efficiency issues of the original Ethereum network. The upgrade introduces a shift from the current proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism. Proof of Stake is a consensus mechanism that enables users to participate in block validation and creation based on the number of cryptocurrency tokens they hold and are willing to “stake” as collateral. This shift reduces the energy consumption associated with traditional mining and allows users to earn rewards through the process of validating transactions.

The Concept of Ethereum 2.0 Staking

Staking involves holding a certain amount of cryptocurrency in a digital wallet to support network operations. In the context of Ethereum 2.0, staking refers to the act of locking up a specific quantity of Ether (ETH) in a smart contract to facilitate network security and transaction verification.

Staking offers several benefits beyond just passive income. Stakers contribute to network security, improve transaction speeds, and also gain the opportunity to earn rewards in the form of additional Ether.

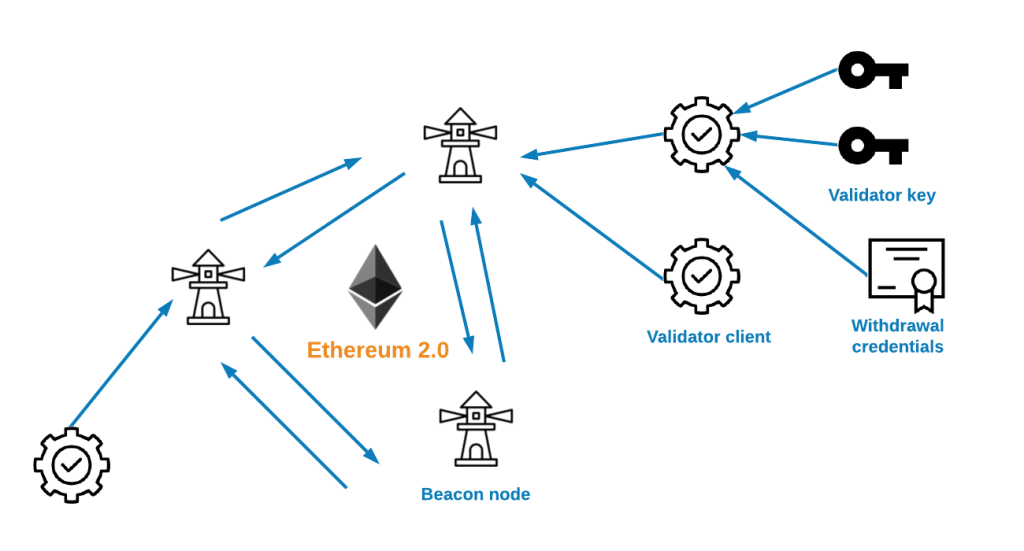

How to Get Started with Ethereum 2.0 Staking

Before you can start staking, you’ll need to set up a compatible Ethereum wallet that supports the ETH 2.0 staking protocol. Some popular options include Metamask, Ledger, and Coinbase Wallet. To participate in Ethereum 2.0 staking, you’ll need to hold a minimum of 32 ETH, which is the required amount for a single staking validator node. This threshold ensures that participants have a vested interest in maintaining the network’s integrity. While you can stake Ether on your own, many choose to use staking providers or staking pools. These services simplify the process, often requiring a smaller amount of Ether to get started and managing the technical aspects of staking on your behalf.

Maximizing Staking Rewards

Staking rewards are typically influenced by factors such as the total amount of ETH staked in the network and the duration of your staking participation. Some staking pools also offer additional rewards, making it crucial to research and compare different options. Stakers can choose between long-term and short-term staking strategies. Long-term staking involves locking up your Ether for extended periods, potentially leading to higher rewards. Short-term staking offers more flexibility but might yield comparatively lower rewards.

Risks and Considerations

While staking can offer stable returns, it’s essential to remember that the value of cryptocurrencies can be volatile. Changes in the market can impact the overall value of your staked Ether. Participating in staking requires technical know-how, and improper setup could result in missed rewards or penalties. It’s crucial to stay informed and seek guidance if you’re unfamiliar with the process.

Leave a Reply

You must be logged in to post a comment.