In the world of cryptocurrency, Ethereum has established itself as a prominent player, offering smart contracts and decentralized applications. However, one persistent challenge that users face when interacting with the Ethereum network is the issue of gas fees. Gas fees refer to the transaction fees required to perform any operation on the Ethereum blockchain. As the popularity of Ethereum continues to rise, so do the gas fees associated with it. This article will explore various strategies to help users navigate and minimize Ethereum gas fees, ensuring more cost-effective transactions.

Understanding Ethereum Gas Fees

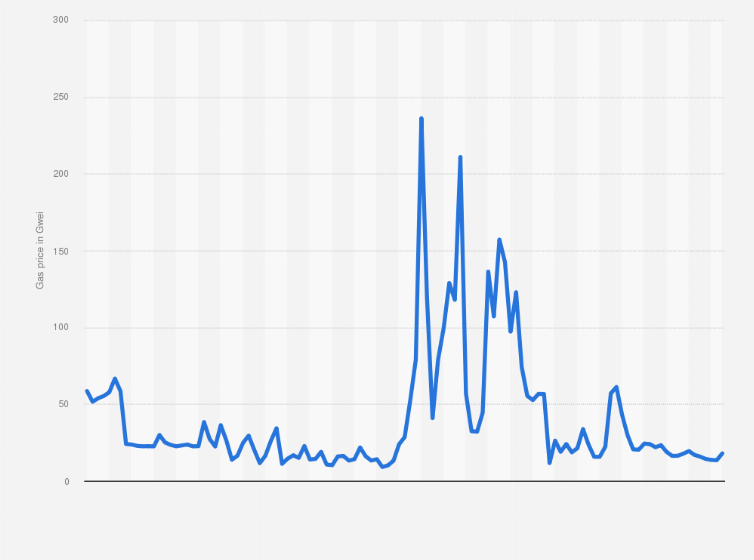

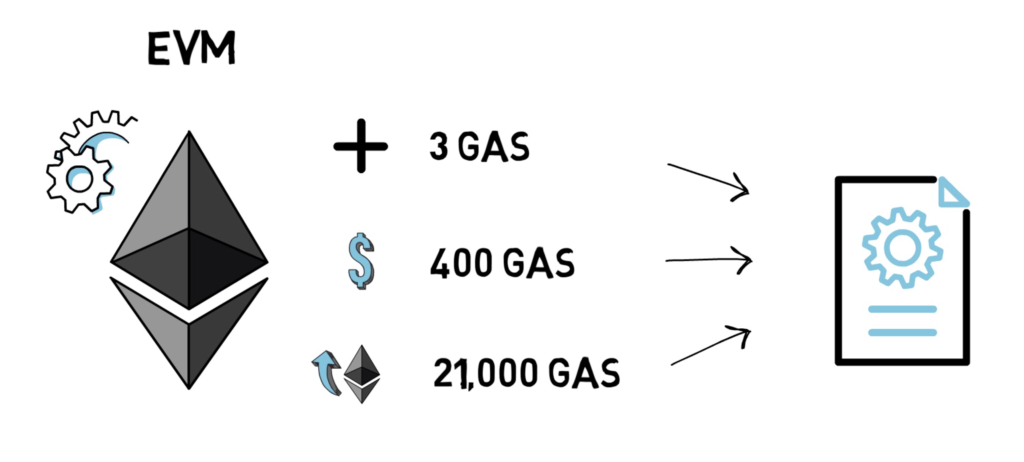

Ethereum operates on a decentralized network of computers, known as nodes, which validate and record transactions on the blockchain. Gas fees are the fees users pay to incentivize these nodes to process their transactions or smart contracts. Users essentially bid on how much they’re willing to pay for their transaction to be prioritized and included in the next block. Gas fees can become high due to network congestion. During times of high demand, the Ethereum network becomes congested, causing a bidding war for block space. Users who offer higher gas fees get their transactions processed first, while others might experience delays or even failures. This phenomenon is particularly evident during ICOs, DeFi protocol launches, and other major events.

Factors Influencing Gas Fees

Network congestion occurs when there are more transactions waiting to be processed than the network can handle. During such times, gas fees can surge significantly, as users compete to have their transactions included promptly. Gas price refers to the amount of cryptocurrency (usually in Ether) a user is willing to pay per unit of gas. Gas price is a crucial determinant of how quickly a transaction will be processed. Higher gas prices lead to faster processing times.

Cost-Effective Transaction Strategies

Off-Peak Timing

Performing transactions during off-peak hours can be a cost-effective strategy. By avoiding periods of high demand, users can take advantage of lower gas fees and reduced competition.

Gas Optimization Tools

Various online tools and platforms offer real-time data on gas prices and transaction times. Users can leverage these tools to monitor the gas fee market and choose optimal times for their transactions.

Layer 2 Solutions

Layer 2 scaling solutions, such as Optimistic Rollups and zk-Rollups, aim to alleviate network congestion by processing transactions off-chain. These solutions offer faster and cheaper transactions compared to the main Ethereum network.

Smart Contract Efficiency

Developers can optimize their smart contracts to reduce gas consumption. This involves writing efficient code that minimizes unnecessary computations and storage usage. Batching transactions involves combining multiple transactions into a single transaction. This strategy can be particularly useful for DeFi users who frequently interact with various protocols.

Wallet Selection Matters

Choosing a wallet that provides accurate gas estimation can help users avoid overpaying for transactions. Wallets that dynamically adjust gas fees based on network conditions are beneficial. Certain wallets allow users to customize gas fees based on their preferences and urgency. This flexibility empowers users to strike a balance between transaction speed and cost.

Leave a Reply

You must be logged in to post a comment.